Make These Brexit Changes In Your SAP System

by Ugur Hasdemir

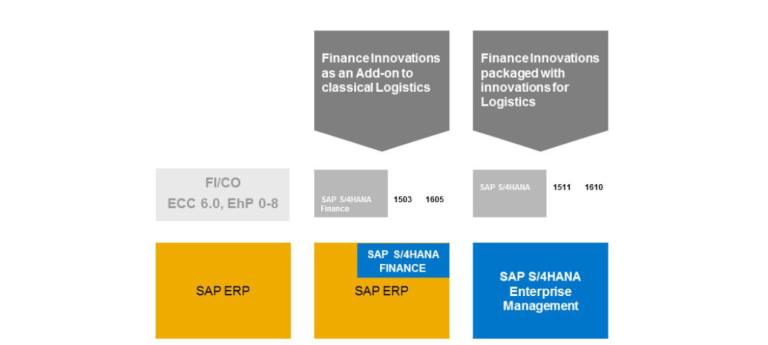

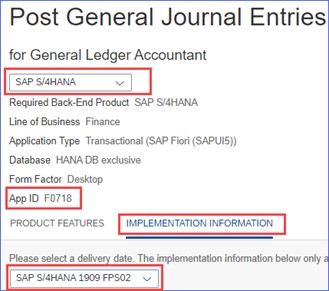

As you know, the UK voted to leave the EU back in June 2016. And now that Brexit is a totally done deal, there are certain changes you will have to implement in your SAP S/4HANA system to comply with the new EU rules and trade agreements.

As you know, the UK voted to leave the EU back in June 2016. And now that Brexit is a totally done deal, there are certain changes you will have to implement in your SAP S/4HANA system to comply with the new EU rules and trade agreements.

The UK has left the EU and thus, became a 'third country' for the European countries. All cross-border transactions between EU and GB (excluding Northern-Ireland) are classified as imports and exports.

In this post I would like to summarize the steps and checks you need to perform to make your S/4HANA or ECC system ready for Brexit. Of course, this heavily depends on if you have legal entities in the UK or do any business with the UK from an EU country.

Changes You Need To Make In SAP

If you have legal entities in the EU or GB, the first things you need to do are:

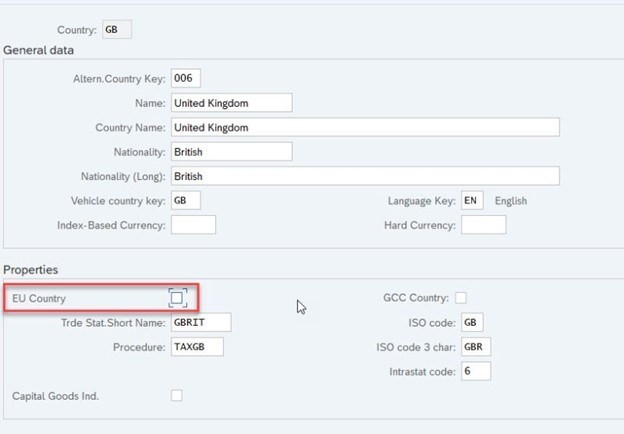

- Deactivate the EU flag for country GB.

- Change your VAT sales conditions. Sales to the UK should be considered export tax, not EC sales anymore.

- Check changes related to Intrastat. The UK is no longer relevant for Intrastat.

- Northern-Ireland is still part of the EU internal market. Northern-Ireland will be classified as XI. VAT numbers should start with XI following the existing numeric GB VAT number.

- For GB company codes, check the newly introduced postponed accounting rules (SAP support note 2996657).

If your trade falls under the NI protocol:

- Northern Ireland will follow both the EU as well as the UK VAT system.

- The NI Protocol is only valid for goods (not for services).

- Update VAT numbers with prefix XI as mentioned above.

- Update all BP master records and organizational units from NI business units with the region. Region codes are provided in the SAP support note shown below.

- Implement several SAP support notes for program corrections.

Important SAP Support Notes for Brexit

While this is not a complete list of all applicable SAP support notes, these three are some of the most important ones for you to review:

- 2885225 – BREXIT: Through the Transition Period and Beyond

This is a central note about Brexit. It also describes all other notes to be implemented for the Northern-Ireland protocol as well. - 2997204 – Intrastat declarations: End of BREXIT transition period on January 01, 2021

This note makes program adjustments to the Intrastat program and describes manual activities for Northern-Ireland. - 2768412 – Recommendations for Brexit in FI

The note includes recommendations applicable to SAP's Financial Accounting module.

You can access SAP's support notes by logging into the support portal. Please note that you will need an SAP-provided user ID (commonly known as an S-User). Access to the support portal is reserved for SAP employees, contractors, customers and partners.

Actions To Take In SAP Financial Accounting for Brexit Changes

Here are some of the most important changes you'll have to implement in SAP's FI configuration. This is certainly not a complete list and, as always, it depends heavily on your specific SAP configuration, but this will get you started.

Company code settings

- Change your company code settings and remove the EU indicator from country GB.

Update XI VAT identification numbers (for Northern Ireland) - should be stored in table T001Z (parameter XIVATN).

Tax codes

Business between the EU and the UK is not considered intracommunity anymore. You should change your tax code determination and change it to export/import instead of intracommunity.

For GB company codes, postponed accounting is introduced. For this, you likely need to create new Tax codes. For details, please check SAP support note 2996657.

Payment settings

The UK will remain in the SEPA area. Here is the official EPC statement:

Brexit and UK PSPs’ participation in SEPA schemes

However, some minor changes apply. For payments over 1000 EUR outside the EU, the payer's address must be included in the payment data. The SAP delivered CGI SEPA CT formats already include the address field. Ensure that your vendor/customer master data is complete so that the SEPA payment files get populated correctly.

by Ugur Hasdemir

More Blogs by Ugur Hasdemir

S/4 HANA 1709 - What you need to know

After a great holiday season it’s time to continue writing and s...

The SAP menu is back in Fiori 2.0

Together with S/4HANA 1610, SAP Fiori 2.0 has been launched. Fior...

Finance in S/4 HANA: What, Why, How & ACDOCA

Nowadays there is a tremendous interest in S/4 HANA, especially from c...

Related Blogs

SAP S/4HANA Fiori App for Classic GUI Transaction...

This is the second in a series of quick look-ups for some of the most ...

The Secret Sauce to Unleashing SAP's Power

In my last AI blog, 7 Tips To Make Your SAP Data Ready For AI, I ...

SAP S/4HANA Fiori App for GUI transaction - Controlling

This is the third in a series of quick lookups for some of the most common GUI...

.png)