A Few Benefits of SAP S/4HANA

This blog is provided by our friends at ERPfixers.com. Have a problem with an SAP issue? Let them fix it for you!

This blog is provided by our friends at ERPfixers.com. Have a problem with an SAP issue? Let them fix it for you!

The business style around us has been changing and becoming more complex. Every one of us has been experiencing a digital transformation. The usage of mobile devices and social media is bringing changes in the way we live, work, and run businesses. New technologies improve work-life and provide us new opportunities in business.

The new SAP S/4HANA has a digital core that offers a unique platform for improving main business processes and develops analytical and decision-making capabilities in real-time.

Many of my SAP ECC customers ask the same question, "What are the insights and benefits of SAP S/4HANA?". I would like to share a few of the benefits out of SAP S/4HANA.

Advantages of SAP HANA Technology

With SAP HANA, the key to optimize application performance is pushing as much of the execution logic into the database as possible. It helps to improve data processing performance. It has faster response times. Many organizations are happy with their optimizations and the resulting response times.

A Few SAP HANA Benefits

- Significant reduction of data volume

- Simplification of data models & programs

- Considerable reduction of backup and restore processes

- Algorithms can be corrected much faster as real data. This is supported by reducing data volume. Data is prepared at runtime and doesn't have to be pre-prepared by using aggregate tables

- Very few efforts for programming to get performance under control

Improvements in the Data Model

Actual Tables

The data model of finance, inventory management, etc.. is simplified in S/4HANA. Only one table for finance, i.e., ACDOCA and only one table for material documents, i.e., MATDOC, etc. Enabled on the fly aggregation, it simplifies the data structure and makes accounting more flexible in the long term as reporting is no longer limited by the number of fields in the totals records.

There are significant changes in the way transactional data is stored for financial reporting in SAP S/4HANA. This brings considerable benefits in terms of the ability to harmonize internal and external reporting requirements. This simplification brings accounting more flexible.

Planning Table

From SAP S/4HANA 1610, it is possible to store the results of planning in the ACDOCP Table. This has the same structure as the universal journal (ACDOCA). Plan/actual reporting will be provided by comparing the entries in the two tables. Integration to SAP Analytics Cloud is also via the new table and master data and reference data and can source from SAP S/4HANA to SAP analytics cloud.

For group reporting, the SAP universal consolidation journal entries table is ACDOCU.

Fixed Asset Accounting

Asset Accounting is based on the universal journal entry ACDOCA. This means there is no longer any redundant data store. The advantage with the new design for fixed asset accounting is no redundancy in data storage, reconciliation between G/L and AA is ensured by design- so it does not require FI-AA reconciliation and all non-statistical items are updated as universal journal entries. You will be able to display reports even after migration. Reporting for previous fiscal years is possible due to compatibility views, even if you convert your system. Depreciation posted with all details: accumulated depreciation and depreciation cost by asset.

FI-AA Reconciliation postings are no longer necessary as a part of closing operations

Asset Accounting and general ledger accounting post to the same table ACDOCA, asset accounting will be reconciled permanently with GL. So, a lot of time saves during the period end as we don't need to do a consistency check of general ledger and asset accounting.

Real-time Updation

For each asset-related transaction example: acquisition, capitalization of assets under construction (AUC), retirement, post-capitalization, etc., asset values for all posting depreciation areas updated in realtime.

Transparent Assignment of Depreciation Area to Accounting Principle

Simplified chart of depreciation. Only one depreciation area per valuation is necessary. Additional depreciation areas (delta areas) not required to portray a parallel valuation, helping in navigation and drill-down per accounting principle.

Separate Document for Each Valuation

Different accounting principles are represented in separate ledgers. Separate accounting-principle-specific documents are posted for each accounting principle.

Accounting Principle specific postings If Any

Accounting principle particular assignments can be done using a separate transaction AB01L for an asset acquisition, a post-capitalization, manual depreciation, or write up.

Cash Management for SAP S/4HANA

The new SAP S/4HANA Finance for cash management provides cash managers with novel user experiences.

The end-to-end process of monitoring bank statement imports, checking cash position and transferring funds to handle surplus and deficit. It also helps in the medium-term liquidity forecast and rolling plans of long-term liquidity. It has centralized bank relationship management, with which business users can manage bank accounts as master data with more business attributes and enables analysis of global bank balances & cash positions, based on data from SAP and non-SAP systems. It comes with integrated liquidity forecasting, central bank relationship management, and equips cash managers with a smart business cockpit.

Centralized Bank Relationship Management

These components help for the approval process for bank account opening, adjustment, and closing, cash position analysis on bank accounts instead of G/L Accounts, signatory integrated with BCM payment approval, plenty of attributes reflecting controls on both bank side and internal side.

Bank account master data stores extensive information like company code & beneficiary name, account number, IBAN & description, bank & SWIFT code, signatory and limit, overdraft limit, connectivity path, account type, contact person, bank details, user-defined fields, attachments, etc.

Integration with Bank Communication Management

Integrated with bank communication management and Fiori App, "bank payment approval." It can define everyone's payment approval limit. Support single sign and joint sign; support both sequential and non-sequential sign. Signatories information used in the payment approval process.

Bank account approval workflow can activate for opening & closing approval, sensitive attributes change approval, batch signatories change, and approval, review process approval, display existing bank accounts in approval, etc.

Cash Pooling

The bank account structure maintenance is done using the new bank account group, which is easy to apply for a business user, without configuration The cash pool detail settings for example: "expected amount" and "minimal movement amount" for every bank account, can be set directly by a business user, without configuration.

While concentrating, it's possible to see the balance* before concentration and the simulated balance after the concentration and adjust the transfer amount if needed.

Transfer Prices

Holding companies may do a transaction with its subsidiary or a division with other divisions within a company; transfer price arises for accounting purposes. It determines costs. SAP S/4HANA has a transfer price solution.

Transfer Price Solution in S/4HANA offers the following:

- Up to three parallel valuation methods for legal, group, and profit center valuation provide the following different perspectives on the value chain within a group

- The legal perspective looks at the business transactions from the affiliated companies including markups

- Profit center valuation treats profit centers as if they were independent companies using, for example, negotiated prices

- Group valuation looks at the whole group eliminating markups

The Business Partner Approach Replaces SAP ECC (ERP) SD Customer Master

In SAP S/4HANA, we don't need to maintain customer master data and vendor master data separately in two transaction codes. It is possible to manage master data for customers and vendors centrally. The link between a business partner and other components is achieved by a role. A business partner role corresponds like customer or vendor etc.

New Accrual Engine in SAP S/4HANA for Accruals

With this, by posting accruals in the system, the relevant costs are allocated to the fiscal period in which they occurred. With release S/4HANA 1809, a new accrual engine has developed. The new accrual engine is called S/4HANA accrual engine. The S/4HANA accrual engine is seamlessly integrating with general ledger. It supports all currencies of general ledger, and postings can perform on ledger level instead of only accounting principle level. The benefits of the new SAP S/4HANA accrual engine are: it is fully integrated into general ledger, all currencies of general ledger are supported, the accrual engine postings are stored in table ACDOCA as line items, the fiscal year variant of the G/L ledgers is supported and standard FI reversal, for example, using transaction FB08 or F.80, is supported.

SAP Fiori App Monitor GR/IR Account Reconciliation

With this app, you can get an overview of the status of open items of GR/IR accounts that need clarification. It helps analyze the GR/IR reconciliation by KPIs for purchase order items and open FI items. After identifying where more in-depth analysis is necessary, you can also navigate the monitor to the list of items for GR/IR clarification, investigate the details, or even start processing purchase order items with no matching goods Receipts and invoices receipts.

It helps in analyzing the situation for the reconciliation processing of unbalanced GR/IR accounts. You can also find which company codes indicate most of the open items in financial accounting? For which supplier exists the most open FI items? Navigate directly to the worklist of items to be processed.

Production Versions are Mandatory in S/4HANA

In S/4 HANA, the production version has been made compulsory for the subcontracting process in purchasing. If the same material is being manufactured in-house and procured from the vendor using the sub-contracting process, two production versions can be created and assigned to the product code. The production version helps you to define different combinations of BOM's.

Flexible Workflow

The flexible workflow in place of the traditional release process for purchase requisitions and purchase orders. It is an alternative to the release strategy. Flexible workflow is a scenario-based workflow that can have more than one start conditions. There is a possibility of determining approvers through a lot of different options. It has an option to specify under which condition should the workflow step be triggered / applicable. It configures using a Fiori App, and approval action can be taken from Fiori App, and it supports Fiori 2.0 push notifications.

MRP Live

The advantage with this is improved performance and execute the planning run in much shorter cycles (10+ times) – several planning runs daily can be achieved using MD01N. The classic MRP run (MD01) also runs on HANA (parallel to MD01N) with the same functionality as on any other database.

More up-to-date supply and demand information on which to base decisions. Faster reaction to demand changes reduces the risk of stock-outs and means that you can reduce safety stocks. Users can identify and react to issues faster than was previously possible.

Lean Service Procurement

With the introduction of new material type SERV, business no longer needs to create a service master. It already has the product type group 'service' in the material type configuration.

Businesses can create materials with material type SERV and product type group 'service' in place of service masters. Purchase requisitions and purchase orders can be created using the Fiori Apps 'manage purchaser requisitions' and 'manage purchase orders' and 'manage service entry sheets.' Services are created as materials with SERV and product type group 'service,' and service lines sub-item levels are not required to maintain in purchasing documents. New material type SERV is created with the reduced user departments and fields in the classical transactions like MM01/MM02/MM03.

SAP S/4HANA Blends Transactions and Analytics

SAP S/4HANA allows operational reporting on live transactional data. This is supported by core data services views for real-time operational reporting. The content is represented as a virtual data model based on the transactional and master data tables of S/4HANA. The embedded analytics are available inside the business processes. This helps in making the processing more efficient.

SAP S/4HANA Financial Closing Cockpit

The SAP S/4HANA financial closing cockpit is an application that enables companies to create a structured interface for executing transactions and programs that form part of complex closing processes; the structural layout supports operations within a company code, as well as scenarios affecting multiple organizational structures. This allows all users who do financial closing for a company code or for numerous company codes to set a manual status for a task, document whether the task has been checked, and manually confirm that a transaction has been executed or not.

Managers who have authorizations to view an overview of the status of the closing process, can access status information, and see issues related to tasks, and job logs, spool lists, or application logs created by the system during task execution.

Companies can use closing cockpit for their month-end and year-end closing activities chronologically and make them available on a standardized interface to all the teams that do these activities.

Harmonizes financial & managerial accounting by using a single data source of truth for all financial and managerial processes. It significantly reduces reconciliation efforts and allows on-the-fly analysis without system limitations from pre-built aggregates. It comes with built-in data migration to seamlessly transform your current data into the new accounting world.

New Depreciation Run

With the new transaction code, the planned depreciation is calculated with every master record change and with every posting on the asset. When the depreciation run is executed, it adopts the projected asset values and posts them in GL. The journal entry is updated in UJE on the asset level. You can perform period-end closing even if there is an error on individual assets. You can also perform a test run. The selection view is simplified.

SAP S/4HANA Finance Credit Management replaces ERP SD Credit Management

FI-AR-CR Credit Management is not available in SAP S/4HANA. The functional equivalent is SAP Credit Management (FIN-FSCM-CR). The FSCM credit management provides enhanced functionality to improve cash flow through the new FSCM functionalities- collections management disputes management. FSCM-CM helps to bring better control over customers' credit scoring with features like managing credit scoring internally and/or storing credit rating of external rating companies, interfacing with credit rating agencies, etc.

SAP S/4HANA Sales

SAP S/4HANA provides significant simplifications in the areas of sales and distribution, capacity planning, etc.

These changes are informed of re-architecting the data model and functions, new user experience, and unifying functionality in the core, in-depth integration into the SAP cloud solution SAP Hybris. Also, you can use complementary sales and billing solutions (like multi-channel-billing).

The changes in sales and billing include the replacement of add-ons and the expanded integrated functional bandwidth such as EWM, PP/DS, and advanced ATP, etc.

Below are some of the areas simplified on SAP S/4HANA sales:

- The business partner approach replaces the ECC ( ERP) SD customer master

- SAP S/4HANA finance credit management replaces FI-AR-CR credit management

- SAP S/4HANA international trade management functionality replaces SAP SD foreign trade

- Migration of financial documents from SD-FT to trade finance in treasury and risk management

- SAP condition contract settlement replaces ERP SD rebates

- SAP revenue accounting replaces SD-BIL-RR revenue recognition

- SAP S/4HANA analytics: ODATA & Open CDS views replace ERP LIS/ODP

Primary Changes in Sales and Billing

Re-architecting the data model, new SAP Fiori Apps & streamlined processes, expansion of the roles, in-depth analytics, and in-depth integration within and across the business lines. To improve efficiency SAP, Leonardo has been introduced to the sales core processes.

SAP S/4HANA helps in the optimized order-to-cash process in Sales. SAP Fiori Apps and analytical views help for managing and controlling sales and distribution. Embedded analytics allows businesses with smart business processes like the sales order fulfillment cockpit. Sales KPIs are delivered out of the box with the flexibility to create dedicated KPIs as per your need. It helps in business transparency. The sales heads get insight into the sales data to make the right decision at the appropriate time. Complexity in the order-to-cash process turns simple with simplified logistics. A variety of options such as simulation and predictive information will help the sales team make the correct decision.

Foreign Trade

The classical foreign trade functionality is not available in SAP S/4HANA; SAP GTS should be used instead.

Rebate Processing

Settlement management replaces SAP SD rebate processing in SAP S/4HANA, which means that existing rebate agreements will only be processed up until the end of the validity date of the agreement and must then be closed by a final settlement. New agreements will only be created based on condition contracts, which are part of settlement management.

Revenue Recognition

SD revenue recognition is not available in SAP S/4HANA. The new SAP revenue accounting and reporting ( RAR) functionality should be used.

This functionality supports the revenue accounting standard as outlined in the IFRS15 and adapted by local generally accepted accounting principles. Migration to the new solution will be required to comply with IFRS15 even if an upgrade to SAP S/4HANA is not done.

Sales Activities

Computer-aided selling is not available. It is recommended that customers use CRM side-by-side with SAP S/4HANA or SAP Hybris Cloud for customers.

Advanced ATP Overview

The advanced ATP is part of SAP S/4HANA. It helps to improve time to deliver, a reduced number of missed business opportunities, and enhanced revenue and profitability. The internal logic for the planning elements from the database to the internal table has been fully redesigned to run in-memory planning. It is integrated into the SAP S/4HANA core.

Advantages

- Promise what you can order, avoid over the confirmation

- Manage shortage situations

- Manage business priorities and protect the interest of the customer

- Intuitive and fast re-planning

Manage Sales Plan SAP Fiori App:

This app helps sales managers to create, change, release, and display their sales plans. They can set sales targets on various dimensions for a planned period. Then they compare the actual sales figures to the sales targeted/planned using the sales performance - plan/actual app.

Sap Fiori App: Sales Performance — Plan/Actual

Users can select one of their sales plan versions to compare with the actual data. After a sales plan version is selected, the plan and real data can be compared as follows:

Planned and actual values represent incoming sales orders or sales volume, depending on what you have planned in the selected sales plan version.

Planned and actual values are compared by month, quarter, or year within the planned period, depending on how you have defined this in the selected sales plan version.

If a customer calls and asks for information on his order, or if our colleague or manager asks for details on all orders belonging to a particular customer, the sales team can use it to provide this information quickly. You need to enter search criteria, such as sales documents, requested delivery date, document date, and customer reference to find the relevant sales document.

Embedded EWM

- Reduce cost through better warehouse efficiency, enhanced labor productivity, and better space utilization. It has process transparency, flexible automated processes, and provides excellent integration with other SAP solutions

- Production planning / Detailed scheduling

- Business benefits from comprehensive planning to production in a single system. It is easy to monitor and for administration. Just a single database to manage

- The sales order fulfillment cockpit

- The Sales order fulfillment cockpit changes the working mode for an internal sales representative. In SAP, there is an exception based working mode to detect issues earlier and improve customer satisfaction by using the sales order fulfillment cockpit in SAP S/4HANA

- It brings benefits to the business in a reduction in O to C cycles as well as outstanding payments, while service level increases. Using this, we get full insights into all issues of the order fulfillment process, and we can focus on the most critical issues, run actions directly, and get track of solution progress. We can also get analytical insights with operational actions

Group Reporting (Financial Consolidation)

Financial consolidation is a very complex topic for accounts and finance departments. It involves complex processes. This is a mandatory exercise for large companies as they have numerous entities, different ERPs, local accounting standards, currencies, etc. play a very significant role.

There is an on-premise solution that is available from SAP S/4HANA 1809 edition onwards. There is also the SAP S/4HANA Cloud for group reporting solution which became available from May of 2017 onwards.

SAP S/4HANA Finance for group reporting stands on the shoulders of consolidation solutions such as enterprise controlling-consolidation system (EC-CS), & business planning and consolidation (BPC).

Some of SAP S/4HANA Group Reporting Features

- Simultaneous legal and management consolidation

- Automated consolidation of investments

- Group structure manager

- Capability to calculate multiple group currencies for a group all in one run

- Integration into the financial closing cockpit

- Integration scenarios with planning applications

- Advanced intercompany reconciliation

- Intelligent data validation leveraging machine learning

- Restatements with less data redundancy

- Customer defined dimensions. (To be verified with SAP)

SAP S/4HANA Manufacturing Benefits

- Newly designed MRP live transaction (MD01N) for optimized MRP run performance. The planning file is optimized for update performance (SAP note 2227059). The primary key is the MRP run's speed, which runs much faster with reduced storage compared to SAP ECC. Therefore, it can be executed more frequently during the day

- Simple logic for sourcing, subcontracting (SAP Note 2226333 and 2227532)

- ABAP list-based process instructions sheets have been replaced by browser-based PI sheets (SAP note 397504)

- Use MED integration or the POI interface instead of outdated interfaces such as PFS, LPO, Icon CBP, KK2, KK5, and s95 interface

- ECL viewer replaced by Visual Enterprise Viewer

- Flow manufacturing and process flow scheduled PFS outdated – use SAP APO instead (SAP note 217113)

- We will be able to move from batch processing to real-time executions

- Manage inventories in the small lot sizes

- Real-time inventory postings and visibility of inventory values

- Higher inventory accuracy

- Reduced safety stocks due to high visibility into stock

SAP BPC Optimized for SAP S/4HANA

Some of the essential capabilities of SAP BPC Optimized for SAP S/4HANA are below:

- Single planning solution

- Real-time access to master & transactional data, for modeling and variance analysis

- Flexible drill-down on drivers for profitability analysis & end-to-end simulation capabilities

- Better and seamless integration of planning screens into SAP ERP workflows

- Pre-built planning models

The advantages of SAP BPC Optimized for SAP S/4HANA are as follows:

- We can overcome the limitations of GUI based planning

- Elimination of data replication

- Plan data transfer of plan data developed in SAP business planning and consolidation to SAP ERP for variance analysis

- SAP business planning and consolidation provides access to real-time master data & actual data maintained in SAP ERP

Enablement of financial planning capabilities based on:

- SAP business planning and consolidation

- An SAP NW version is seamlessly integrated into SAP ERP user interfaces & workflows, effectively replacing the current planning capabilities in SAP ERP

- End-to-end simulation capabilities

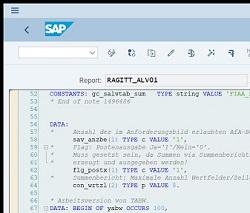

Budget Availability Control for Cost Center

The standard SAP R/3 System has no active availability control for cost centers. You can exceed the cost center budget without corresponding messages. If anyone wants availability control for postings to cost centers, we used to use indirect solutions for primary postings. We will be able to activate AVC for cost centers in S/4HANA 1909.

We can create a budget availability control profile, assign budget relevant account groups, and define budget tolerance limits to control the budget consumption in cost centers.

When users post expense, which is tagged as an actual cost, the available budget is checked. When the budget consumption reaches a defined limit, the system responds with either a warning or an error message. This system response depends on the settings that you have specified in the budget availability control profile.

If you create a purchase requisition or a purchase order assigned to a cost center, a commitment is generated. This commitment reduces the available budget.

SAP Fiori Apps

SAP Fiori offers a new web-based user experience based on HTML5 and the UI5 framework. It provides capabilities to users to both personalize and adjust the screens. SAP Fiori offers the power to deliver a state-of-the-art user experience.

Conclusion

SAP S/4HANA is a real-time business suite for digital business. It allows IT to connect to social & business networks (for example, Ariba and Concur) and the "internet of things." SAP S/4HANA comes with very innovative and new feature rich-applications, which make it accessible to get insight from real-time data anywhere. Planning, execution, prediction & simulation are all made "on-the-fly," at the highest level of granularity, to drive faster business impact.

It is designed with SAP Fiori UX, enabling business users to get the job done with a personalized, responsive, and simple user experience available on any device. In short, SAP S/4HANA is the reimagined business suite for reimagining business.

More Blogs by ERP Fixers

Optimization of Cash Operations using SAP Cash...

This blog was provided by our friends ERPfixers.com - need help fixing...

Related Blogs

Optimization of Cash Operations using SAP Cash...

This blog was provided by our friends ERPfixers.com - need help fixing...

SAP ABAP on HANA Training

Mastering the SAP skills needed to work with data properly can help you reach...

.png)