How Does the GR/IR Process Work in S/4HANA and Fiori?

by Oona Flanagan

When looking at how the GR/IR (goods receipt/invoice receipt) process works, there are 3 questions that often come up: are the postings the same, how do I reconcile and maintain the GR/IR account, and how does it all work using Fiori apps in S/4HANA?

When looking at how the GR/IR (goods receipt/invoice receipt) process works, there are 3 questions that often come up: are the postings the same, how do I reconcile and maintain the GR/IR account, and how does it all work using Fiori apps in S/4HANA?

This blog will seek to answer and explore those common queries.

3-Way Matching

If you correctly approve a purchase order (PO) and record the goods receipt (GR), then when the invoice arrives, if everything matches, (Figure 1), no further authorization should be necessary. The problem occurs when all three do not match. The PO price might be wrong, the wrong quantity receipted, or there might be a mistake on the invoice.

Figure 1 Three-Way Matching Process

S/4HANA is designed so that most goods and invoices are posted to a control account (GR/IR) to help analyze what has been received and also to accrue for what has not.

When the goods arrive, the GR/IR account is credited and the stock or cost account is debited. When the invoice arrives, the GR/IR account and relevant tax accounts are debited and the vendor is credited. In a perfect world, the only balance on the GR/IR account would be timing differences.

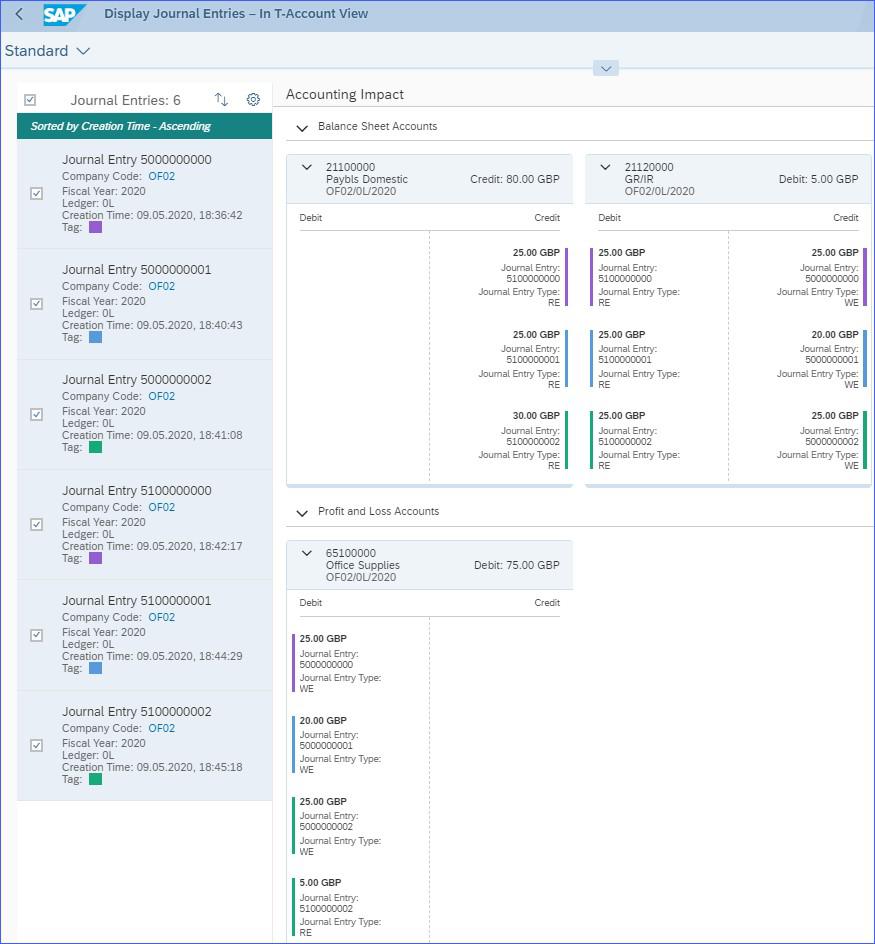

If you like T-accounts, you’ll love the Fiori App Display journal Entries in T-Account View (Figure 2), showing the following 3 examples.

Example 1 (Purple): PO = 5 items @ £5, GR = 5, invoice = £25 (No errors)

Example 2 (Blue): PO = 5 items @ £5, GR = 4, invoice = £25 (Quantity error on GR)

Example 3 (Green): PO = 5 items @ £5, GR = 5, invoice = £30 (Price error on invoice)

Figure 2 Display Journal Entries in T-Accounts View

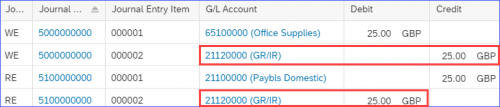

Example 1 (PO=GR=IR)

The debits and credits in the GR/IR account match, (Figure 3), so all that’s left, is to run the Clear Open Items app, which uses the GUI transaction F.13 to automatically clear all matching items.

Figure 3 Example 1 - Matching Goods Receipt and Invoice (also T-Accounts App)

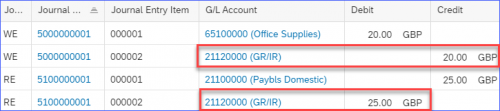

Example 2 (GR

Figure 4 shows a balance on the GR/IR because more has been invoiced than received.

Figure 4 Example 2 - Invoice Quantity Higher than Goods Receipt Quantity

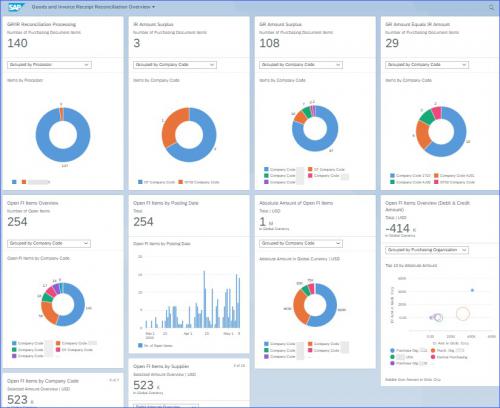

To analyze multiple balances more efficiently, you can use the Monitor GR/IR Account Reconciliation app (Figure 5) and drill down to the Reconcile GR/IR Accounts (Figure 6), app from e.g. the Invoice Amount Surplus card.

Figure 5 GR/IR Overview (Monitor)

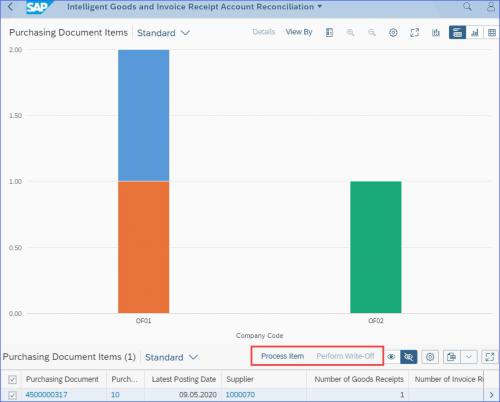

Figure 6, Reconcile GR/IR Accounts shows company code, but you could add plant, supplier, material, purchasing group etc. The table reflects the selected items and I can add or rearrange the columns using the settings button.

Figure 6 Reconcile GR/IR Accounts

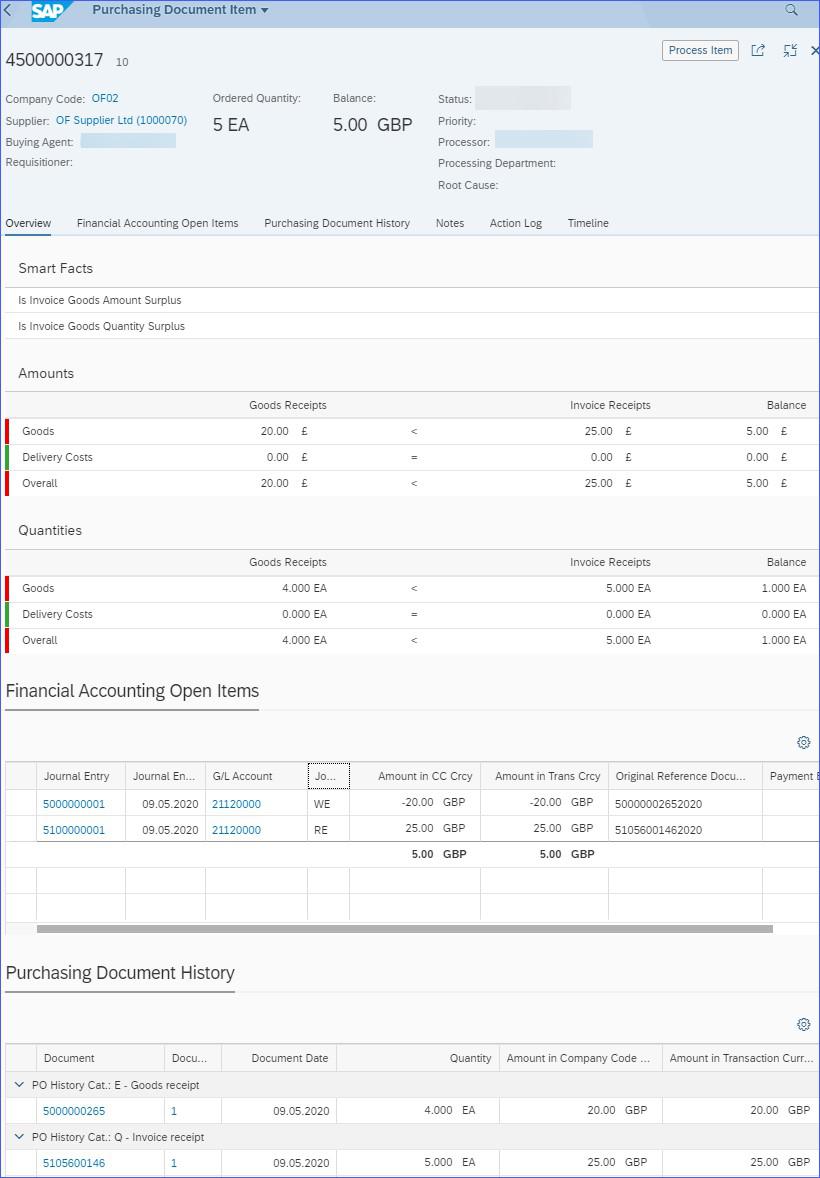

Selecting an item in the chart allows me to first Process Item, and then if necessary Perform Write-off, (similar to MR11 in the GUI), or I can drill down into the detail (Figure 7), by clicking the arrow to the right of the item. It’s a bit overkill for a simple example, but good if you have dozens of transactions against one PO.

Figure 7 Purchase Document Detail

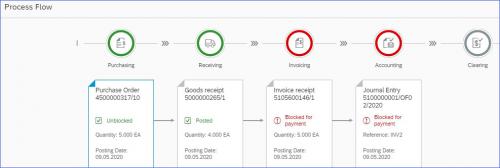

If we look at the Display Process Flow app in Figure 8, the invoice is blocked for payment. Simply unblocking the invoice will NOT resolve everything and will leave a balance on the GR/IR. There are several possible actions, depending on who is at fault. If there was a mistake counting the goods then an adjustment GR can be posted and once the 3-way match has been refreshed, (transaction MRBR or Release Blocked Invoices app), the invoice can be paid and the GR/IR cleared. Same, if the supplier has made a mistake, and sends the missing items, or a credit note.

Figure 8 Example 2 Process Flow

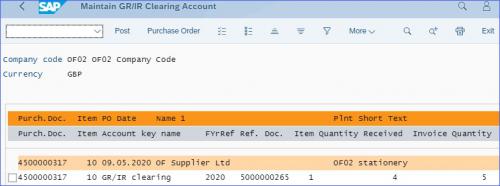

If the error is tiny or discovered too late to correct the stock or chase the supplier, an alternative is to write off the difference. This can be done in the app in Figure 6, using the Perform Write-Off button or using the app Clear GR/IR Clearing Account, (transaction MR11), which enables you to clear the GR/IR account without affecting the stock, (Figure 9).

Figure 9 MR11 - Maintain GR/IR Clearing Account

Example 3 (IR>PO)

In Figure 10, although the invoice is for £30, because the quantity matches, £25 is posted to clear the GR/IR account, and the remaining £5 is posted either to costs, (or stock/price variance depending on the item).

Figure 10 Example 3 - Price Difference

If we look at the process flow, (Figure 11), the invoice is blocked for payment.

Figure 11 Display Process Flow

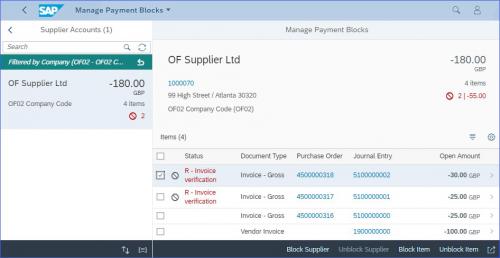

If the supplier is at fault and sends a credit note, you must choose the Subsequent Credit option when posting the invoice as this will update the cost or variance accounts without touching the GR/IR account. You could correct the PO and refresh the 3-way match or just unblock the invoice with the Manage Payment Blocks app (Figure 12). However, don’t forget to amend the source documents, for example, info-records, to ensure that you don’t use the wrong price next time.

Figure 12 Manage Payment Blocks

Comparing Balances

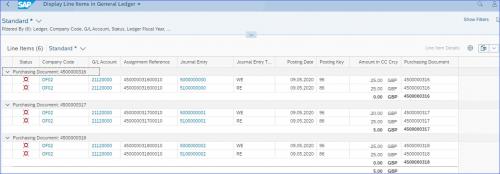

Note that the GR/IR balance in the Reconcile GR/IR Accounts (Figure 13) should match the balance in the Display Line Items in the General Ledger app (Figure 14).

Figure 13 Balance in GR/IR Monitor/Reconciliation

Figure 14 Balance of GR/IR Account in G/L Account Line Item Display

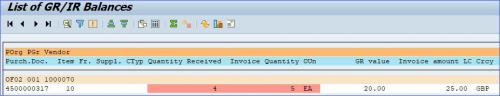

You can also compare the above with the balance on the GUI transaction MB5S, see Figure 15.

Figure 15 Transaction MB5S List of GR/IR Balances

Other Scenarios

Where IR < GR, although the invoice will not be blocked for payment, you still need to clear the balance from the GR/IR account. Note; if the invoice is received first, the GR/IR postings will be at invoice value rather than the PO.

In Summary

There’s a lot more you can do in this area, such as release blocks using workflows, use machine learning, jump between apps, save variants, save as tiles, export to Excel, and so on, and there’s a lot more functionality generally in Fiori. Personally, I find Fiori apps easier to work with than the old GUI transactions and I hope the blog has helped you see what is available.

My current SAP courses cover asset accounting, legacy asset transfers and Fiori reports and embedded analytics. In addition, I’m hoping to do a series of mini deep dive courses into some of the apps shown above in the future, but please feel free to contact me on LinkedIn.

Finally, I can’t stress enough that you should not just unblock invoices in order to pay them where quantities are involved, as the balance will stay on the GR/IR account indefinitely. If there is a quantity difference, your stock may be wrong, your moving average prices may be incorrect and you may be over-paying your supplier for items that you have not had.

by Oona Flanagan

More Blogs by Oona Flanagan

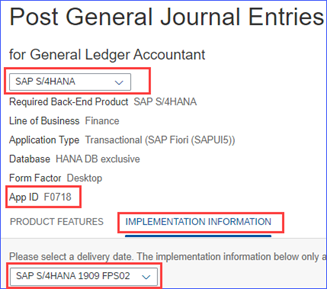

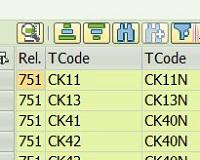

SAP S/4HANA Fiori App for GUI transaction - Controlling

This is the third in a series of quick lookups for some of the most co...

SAP S/4HANA Fiori App for Classic GUI Transaction...

This is the second in a series of quick look-ups for some of the most ...

Finding an SAP S/4HANA Fiori App for SAP Classic GUI...

This blog is the first in a series of quick look-ups for some of the m...

Related Blogs

What is the SAP Cloud Platform?

The SAP Cloud Platform (SCP) is the next-generation platform to create...

How to Build an SAP Business Case

Whether you’re a CIO at an SAP Client Company, SAP Project Manag...

How to find obsolete transactions in S/4HANA

Many transactions have been deprecated in SAP S/4HANA from ERP6.0. In fact,...

.png)